How To Print W2 For Employees From Quickbooks Without Payroll Service

Every employee receives a Westward-2 form at the stop of the fiscal year by his employer. Information technology is a argument that contains data related to the salary/wages that an employee is paid past his employer. Likewise, it also tells about the deduction of taxes from his paychecks. All this information is required by the employee for preparing his taxation returns. Your employer keeps unlike copies of this form and frontwards information technology to three different parties: the federal government, the state authorities, and the employee. No matter whether you're a QB desktop or an online payroll user, y'all can print the Westward-two form in both versions of QuickBooks. Before y'all proceed with the press process, y'all need to empathise the W-2 grade and its importance.

If you lot need an expert'southward assistance to print West-2 in QuickBooks, so you must get in touch on with our team. Requite us a call on our Asquare Deject Hosting Helpline Number and we volition provide y'all instant support.

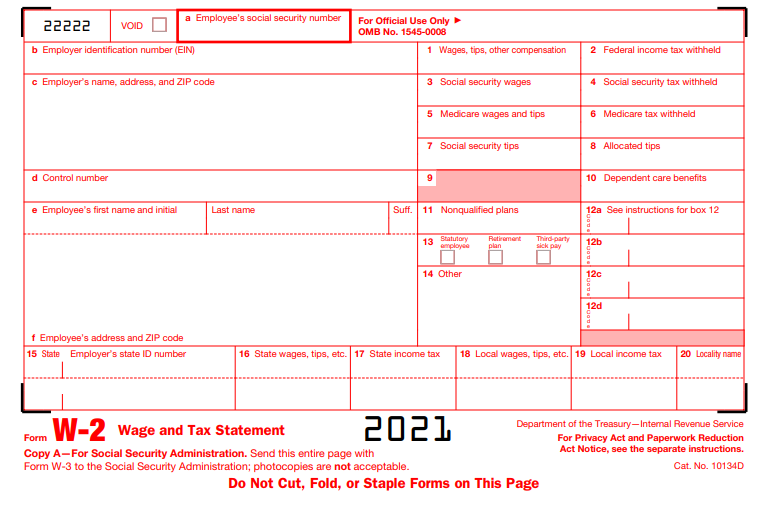

What Is A W-2 Grade?

W-2 Form is also known as the Wage and Revenue enhancement Statement form. Information technology is a document that an employer has to ship to all his employees and the Internal Acquirement Service (IRS) at the terminate of the year. A Westward-2 reports employees' annual wages and the amount of taxes retained from their paychecks. A West-2 employee is someone whose taxes are deducted from their paychecks by his employer, and he further submits this information to the government.

An employer must ship the West-2 form to every employee to whom they pay bacon, wage, or another form of compensation. It doesn't account for contracted or self-employed workers, as they file taxes with different forms. The W-two course must be sent on or before January 31 each year so that one has sufficient time for filing the income taxes before the deadline, i.e., April xv (in most years). 1 files the taxation documents for the previous year. For instance, say you received a W-2 form in January 2021. It signifies the income that you earned in 2020.

NOTE: If you are amidst those affected by the February 2021 snowstorm disaster in Texas, y'all must know that the borderline for revenue enhancement filing has been postponed to June 15, 2021. Yous are eligible for the extension even if y'all don't live in Texas but were affected past the storm.

Requirements to Print W-two Form in QuickBooks

Below, we have mentioned some of the basic requirements you must fulfill before creating employee W2 in QuickBooks and print it.

- Use the updated version of QuickBooks while printing the W-2 grade. The QB version must be compatible with the Windows OS installed on your desktop.

- The QuickBooks Payroll Service must be active.

- The W-ii paper must be uniform with the payroll service and the printer.

- Yous can either use bare or perforated paper or the pre-printed form of laser printer. Besides, you can also use pre-printed inkjet printer newspaper.

- Make sure to have the latest release of the payroll revenue enhancement tabular array.

Verify the Payroll Service Yous're using Before Start Printing W-two

Before you lot brainstorm to impress the W-2 form in QuickBooks, it's essential for you lot to know nigh the version of QuickBooks Payroll that yous are currently using, as the process may vary for each version. Still, if you are confused and aren't aware of it, then you must follow the below-given steps:

- Firstly, sign in to QuickBooks Online.

- Get to the settings and select the Accounts and Settings option, followed by Billing Subscription and Payroll.

- Now, click on Plan details, and yous volition get to know the payroll plan you currently take.

- If it shows Enhanced or Basic, it signifies QuickBooks self-service payroll.

- Whereas, if information technology is Full-service payroll, then it means y'all have QuickBooks Full-service payroll version.

However, if you are a QuickBooks desktop payroll user, you must follow the steps mentioned here to know about your current payroll service.

How To Print W-2 For Employees In QuickBooks?

The steps you demand to follow to impress the W-2 course in QuickBooks solely depend on your determination whether you want to pay and file your federal and state payroll taxes on your own or want Intuit Quickbooks to practise it for you. If yous aren't sure about it, then you must go through your automatic revenue enhancement payments and grade filing condition in the get-go place.

Note: The option of printing W-2 forms is not available in the QuickBooks desktop payroll basic version. Thus, yous have to upgrade to some other version, such every bit QuickBooks desktop payroll enhanced.

Two Ways To Print Westward-two Course In QuickBooks:

As mentioned, there are different versions of QB payroll available. Out of these, some services give you the option to pay and file the tax for you while using others y'all can pay on your own. No matter which service you have, we got you covered. Basically, in that location are 2 ways of printing the Due west-2 form in QuickBooks depending upon the below-mentioned conditions.

- When Intuit QuickBooks Pays and File your taxes For you.

- When You Pay and File your taxes on your ain.

Status i: Print W2 When Intuit QuickBooks Pays and File Taxes for y'all

If you are using a payroll service that falls nether this category, you don't demand to worry about the filing procedure. All will be taken care of past the QuickBooks payroll service. If you're using whatever of the below-mentioned payroll services, then Intuit will file taxes for you:

- QuickBooks Online Payroll Cadre, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite

- QuickBooks Online Payroll Full Service

- Intuit Online Payroll Total Service

Intuit mail all your employees the Westward-2s starting January 20 through January 31. However, if you want it from January thirteen, you can re-print it on manifestly paper. For that, you may follow the beneath-given steps:

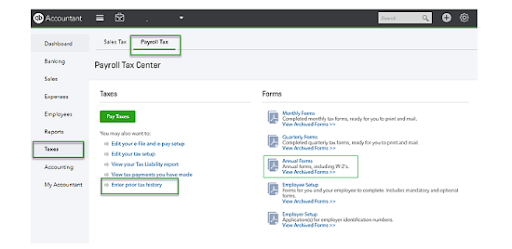

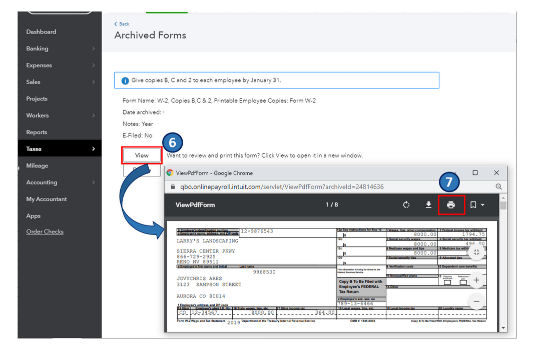

- Open up QuickBooks Online and go to the Taxes menu.

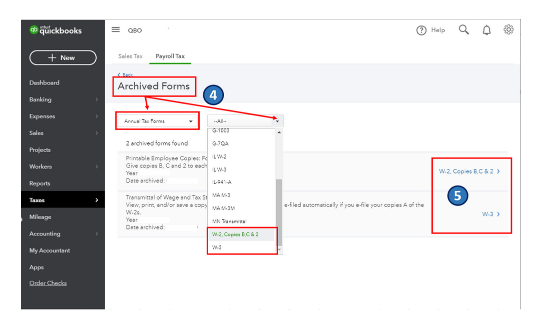

- Now, select the Payroll Tax pick followed by Filings and Annual Forms.

- Here, you lot will have the option of press both employer and employee copies of your W-2s and W-three.

- Employer Copies: Grade W-ii (West-two, Copies A & D), Transmittal of Wage and Tax Statements (Due west-3)

- Employee Copies: Form Due west-ii (W-2, Copies B, C & 2).

- If y'all oasis't set upward your Westward-2 printing preferences by at present, a prompt volition appear on your screen: Before filing this grade, you must set upwards Westward-ii printing. Click on it and select your paper.

- Further, select the required filing period from the dropdown carte.

- Open Adobe Reader in a new window past clicking on View.

- Select the print icon from the Reader toolbar. So, click on the Print option one time again.

NOTE: If your employee lost or didn't get the original Westward-2, so you have to reprint the form. In that case, you have to write a REISSUED Statement on superlative of information technology. Along with that, likewise attach a copy of the Due west-2 instructions.

Status 2: When You Pay and File your Taxes on your own

Beingness an employer, you lot need to print and mail W-2s to your employees postmarked by February one if the payroll service y'all are using falls under this category. We have listed all the related services below:

- QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite

- QuickBooks Online Payroll Enhanced

- QuickBooks Desktop Payroll Enhanced, QuickBooks Desktop Payroll Standard.

- Intuit Online Payroll Enhanced

You need to follow certain steps if yous want to file and pay the taxation manually or using whatever of the above stated payroll services.

Step 1: Purchase your W-2 newspaper

If you plan to order the W-ii kits, we would suggest you give our services a endeavor. For that, you need to follow these steps:

- Firstly, get to QuickBooks check and supplies and select Tax products followed by Blank W-2 kits.

- To place your order, follow the instructions that prompt on your screen

We clinch y'all that information technology volition let you print the W-2 grade in QuickBooks without any mistake, and thus, none of your employees would take any issues. You tin print the employee copy on either of these papers:

- Blank three-part perforated paper

- Blank 4-part perforated paper

One time you lot take the W-2 newspaper, y'all need to set your printing preferences. And, for that, you must keep to the adjacent step.

Step 2: Set Your Printing Preferences

You can change or set your printing preferences by following the beneath-given steps:

- Become to settings and select the payroll settings selection.

- From the W2 print preference tab, click on Edit.

- Lastly, select your newspaper type and click on OK.

NOTE: However, this pace varies for QuickBooks Desktop Payroll Enhanced and Standard service users. For these, you take to update QuickBooks desktop and payroll tax tabular array as per the latest available version. It helps QuickBooks to calculate the correct tax amount as per the current taxation rates.

At present, you're all ready to print the W-2 forms. To know how, become to the next stride.

Footstep 3: Now Print the Filed W-two Forms in QB

If you have decided to file and pay the revenue enhancement on your own, and so you must impress your W-2s from the start of January 1.

- At first, select Taxes followed past Payroll Revenue enhancement.

- Now, select the Filings selection and then select Annual Forms.

- At this signal, y'all will have the pick to print both employer and employee copies of your W-2s and W-3.

- Employer Copies: Form Westward-2 (Westward-2, Copies A & D), Transmittal of Wage and Tax Statements (W-3)

- Employee Copies: Grade W-two (W-2, Copies B, C & 2).

- A prompt volition popular up stating Before filing this form; you must set W-2 printing if you wouldn't have set your W-2 printing preferences. Click on it and select your printing paper.

- Farther, select the required filing period from the dropdown.

- Click on View to open up the Adobe Reader in a new window. And and then, select the print icon on the Reader toolbar.

- Lastly, select the Print pick in one case again.

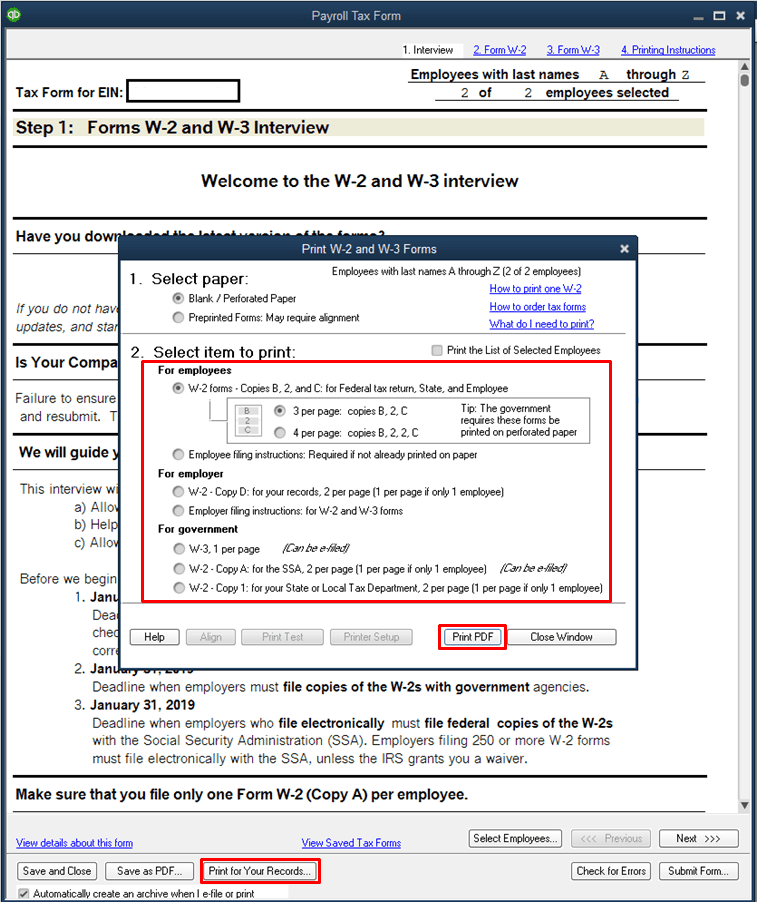

Important: The last step slightly differs for the QuickBooks Desktop Payroll Enhanced, QuickBooks Desktop Payroll Standard version. For this service, you need to follow the below-given steps:

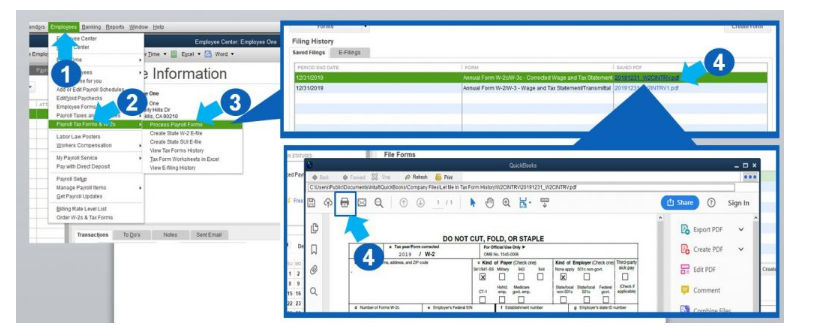

- Select Payroll Tax forms & W-2s followed past Process Payroll Forms from the Employees dropdown bill of fare.

- Whorl downwards from the File forms tab and select Annual Form W-2/W-three – Wage and Taxation Statement/ Transmittal.

- At present, click on the Create grade option and select all or individual employees to file.

- Mention the year and click on OK.

- Over again, either select all or individual employees to print.

- Make sure to review each W-2 by clicking on Review/ Edit. A bank check mark identifies these W-2s in the reviewed column.

- At final, select the submit form selection and impress and file the course by post-obit the on-screen instructions.

NOTE: Equally mentioned before, you have to write REISSUED Argument on the top of your West-two copy if your employee lost or didn't receive the original Westward-2 form. Likewise, brand sure to attach the W-2 instructions copy.

How Can You Print W-two Form In QuickBooks Desktop Payroll Assisted With Self Print Pick?

Wondering how to print the Due west-2 form in QuickBooks while using the Payroll Assisted version on your QuickBooks Desktop! It's possible with the Self Print selection by following the given steps.

- Follow the below-given steps to open the Payroll Tax center:

- Open QuickBooks and click on Payroll Center nether the Employees card.

- Click on the File Forms tab and select the View / Impress Forms & Due west-2s option.

- And then, enter your payroll PIN.

- Now, click on the W-two tab.

- If you want to print forms for all the employees, click on the checkbox against the Employee. Else you lot may select the specific employee names.

- Click on the Open/Save Selected option.

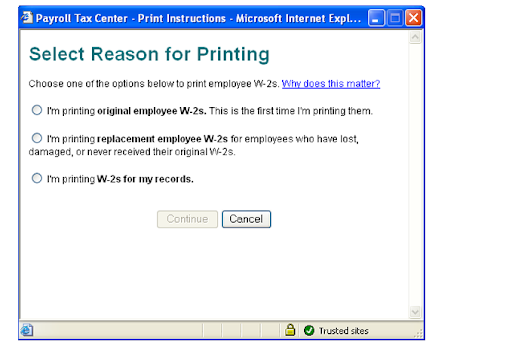

- Choose the specific reason for press the W-2s when the Print Instructions window appears on the screen.

- If the employee is receiving the Westward-2 for the first fourth dimension, click on I'chiliad printing original employee Westward-2s option.

- However, select the I'm printing replacement employee W-2s option if the West-2 form is lost or damaged.

- If you are printing the W-2 for the company records, select the concluding pick I'grand printing W-2s for my records.

- Based on what y'all select in the last step, a message related to printing newspaper volition appear on your screen. Thus, yous have to load the correct paper into your printer.

NOTE: If you lot don't take the perforated paper (information technology has the instructions for filing the Westward-ii forms on the back) at the time of printing W-two form, you can print it on plainly paper with the condition that you lot provide appropriate W-two filing instructions to your employee.

- When the Adobe Reader file opens with your Westward-two selections, click on the File bill of fare and select Print to print the Due west-2s.

Important: You must know that the QB Desktop Payroll Assisted uses 4-up paper (four horizontal W-2s per page).

Need Help in Printing W-2 Forms!

Nosotros have tried our all-time to explain the procedure to print W-2 form in QuickBooks desktop and online in the easiest way. Yet, information technology might exist a flake tricky for some users. In such a situation, we would advise you take professional assistance from our experts by placing a call on Asquare Deject Hosting Helpline Number. Our squad is available round the clock to provide immediate support.

Oft Asked Questions about W2 Course Printing

i. Can you print w2 forms in QuickBooks on manifestly paper?

You can print W-two form in QuickBooks in either of these papers: bare or perforated paper and pre-printed W-2 forms.

2. How to receive w2 from the previous employer online?

You tin follow the below steps to get Due west-2 from your previous employer online:

a). Firstly, you accept to check the payroll. You can get W-2 by calling or sending an email to the payroll administrator.

b). At terminal, you lot can make a telephone call to the IRS.

iii. How tin can I study an employer if he hasn't sent Westward-two?

Follow these steps if you desire to report an employer for not sending you the Westward-ii:

a). At kickoff, you must contact your employer.

b). Then, contact the IRS team if you lot oasis't received your W-2 course by February 14th.

four. How to get my W2 from my previous task?

If that's the case, then you lot must call or email your payroll administrator. Further, you likewise have to confirm your mailing address. Else, you can place a call to the IRS.

5. What happens if I don't get my W2 by Jan 31?

If you haven't received your W-2 by Jan 31, and then you must follow these steps:

a). Contact your employer in the first place.

b). And so, endeavor to get in touch with the IRS.

c). After that, you accept to file your return, followed by Form 1040X.

How To Print W2 For Employees From Quickbooks Without Payroll Service,

Source: https://asquarecloudhosting.com/how-to-print-w-2-form-in-quickbooks-desktop-online-explained/

Posted by: gardinanday1996.blogspot.com

0 Response to "How To Print W2 For Employees From Quickbooks Without Payroll Service"

Post a Comment