What Is 2018 Tax Law For Personal Service Corporationsc

Corporate tax rate and corporate alternative minimum tax

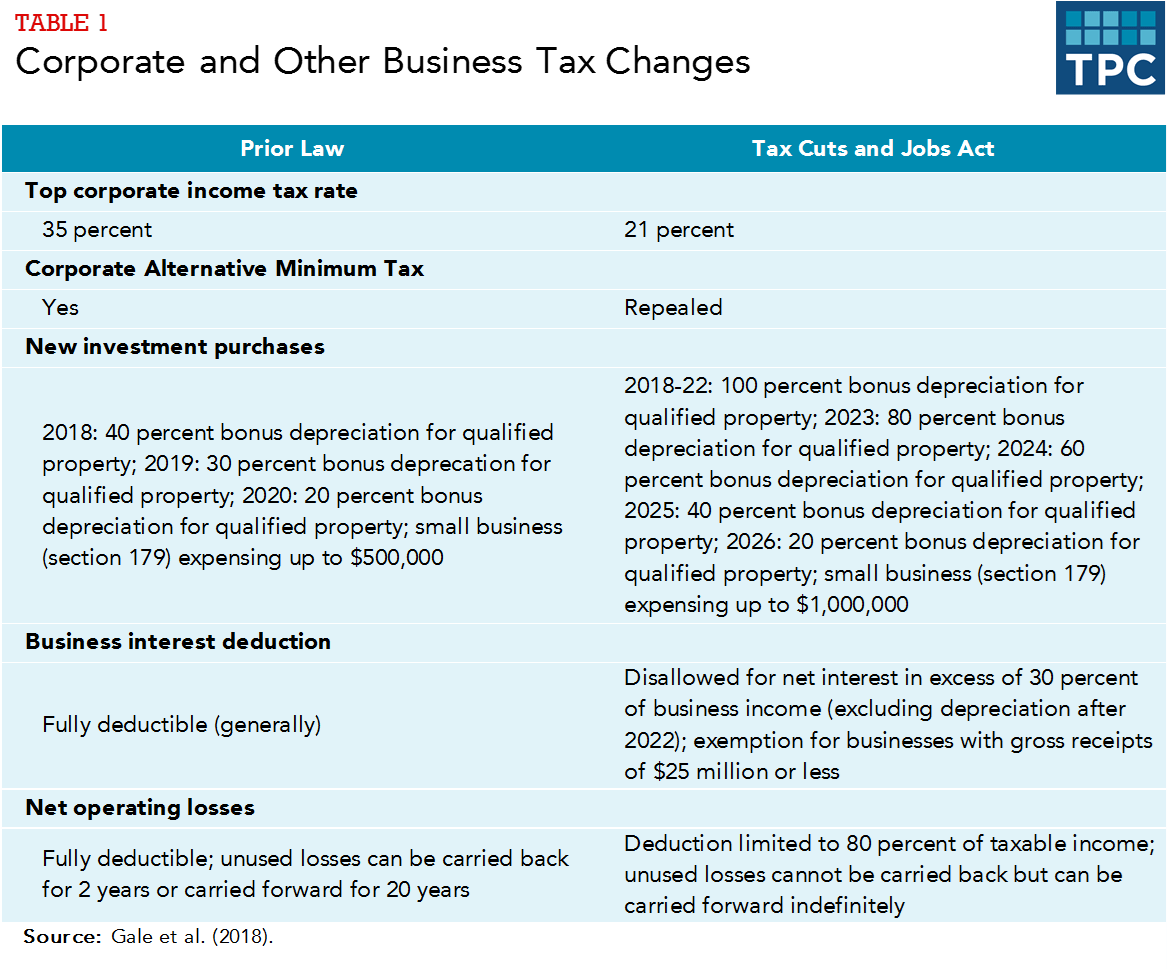

The Revenue enhancement Cut and Jobs Act (TCJA) reduced the peak corporate income revenue enhancement rate from 35 percent to 21 pct, bringing the US rate below the boilerplate for nearly other Organisation for Economic Co-performance and Development countries, and eliminated the graduated corporate rate schedule (tabular array one). TCJA also repealed the corporate alternative minimum revenue enhancement.

Tax Rates and Tax Brackets

TCJA allowed businesses to deduct the full cost of qualified new investments in the year those investments are made (referred to every bit 100 percent bonus depreciation or "full expensing") for five years. Bonus depreciation then phases downwards in 20 percent point increments beginning in 2023, and is fully eliminated after 2026. Prior constabulary allowed l percent bonus depreciation in 2017, decreasing the percentage in subsequent years and fully eliminating it after 2020.

TCJA doubled the Section 179 expensing limit for investments past pocket-size businesses from $500,000 to $1,000,000 for qualified property (sometimes called "small business organisation expensing"). It also simplified accounting rules for smaller firms.

TCJA limited the amount of net business organisation interest (interest paid less interest received) that businesses can deduct to thirty percent of business concern income before involvement, depreciation, and amortization. Starting in 2022, the adjustment for amortization and depreciation will be removed from the limitation. Businesses with gross receipts below $25 one thousand thousand are exempt from the limitation. Previously, involvement paid was generally fully deductible in computing taxable income for all businesses.

TCJA limited the deduction for net operating losses to 80 percent of taxable income. It too repeals carrybacks of losses, except for certain businesses, just allows taxpayers to comport forward losses indefinitely. Under prior police force, net operating losses could offset 100 percent of taxable income and businesses could acquit dorsum unused losses for two years or carry them forward for 20 years.

The new constabulary also eliminated the domestic production activities deduction (Department 199) and modified other smaller provisions such as the orphan drug credit, the deduction for Federal Deposit Insurance Corporation premiums, and the computations for life insurance reserves. In addition, starting in 2022, expenditures for research and experimentation must be amortized over five years (fifteen years for offshore research and experimentation expenses) instead of beingness immediately deductible.

Pass-through business income deduction

Unlike C-corporations, laissez passer-through firms such equally sole proprietorships, partnerships, and Southward-corporations are not subject to the corporate income tax. Instead the owners include their share of profits as taxable income nether the individual income revenue enhancement.

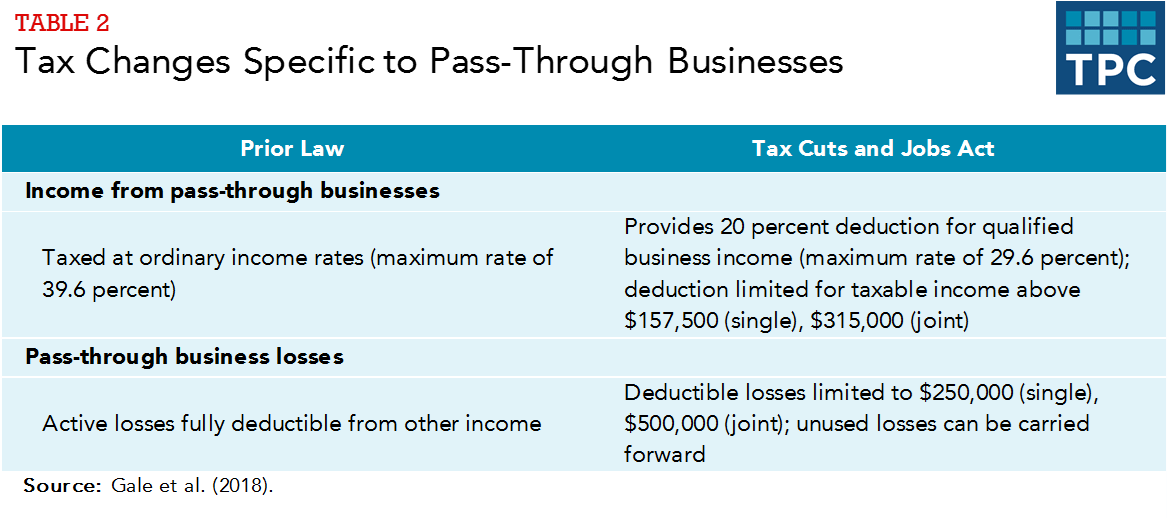

In general, TCJA'southward changes to the business income revenue enhancement base, including the limits on involvement deductions and net operating losses, apply to pass-through businesses equally well as to business subject to the corporate income tax. Still, TCJA included changes specific to pass-through businesses (table 2). The pass-through businesses specific provisions are scheduled to expire after 2025.

TCJA introduced a complex new deduction for income from pass-through businesses. Under the new law, articulation taxation filers with taxable income beneath $315,000 ($157,500 for other filers) can deduct 20 percent of their qualified business income (QBI). The 20 percent deduction lowers the effective top individual income tax rate on business income from 37 to 29.half-dozen percent.

If taxable income exceeds those thresholds, nonetheless, the deduction can be reduced depending upon the type of business, the wages paid, and the investment property owned past the business organisation. For personal service businesses (such as law firms, medical practices, consulting firms, or professional athletes), QBI phases downward on a pro rata basis. Once taxable income reaches $415,000 for joint filers ($207,500 for other filers), QBI is zero and there is no longer whatever deduction.

For all laissez passer-through businesses, whether they are personal service firms or non, an additional two-function formula limits the deduction in one case taxable income exceeds the $315,000/$157,000 thresholds. Under the formula, the deduction is limited to the greater of either 50 percentage of the wages the business pays its employees or 25 percent of wages plus 2.5 percentage of the basis of the business concern' qualified belongings. Business organisation owners compare those calculations to 20 percent of their QBI and may deduct only the smaller corporeality. The limit on the deduction phases in over the aforementioned income range as in a higher place.

Limit on Pass-through business losses

A major reward of organizing equally a pass-through business organisation rather than as a C-corporation is that pass-through business owners tin can use business losses to starting time taxable income from other sources. TCJA limits the amount of active pass-through business losses that business owners can deduct against other income to $500,000 for joint filers ($250,000 for other filers). Unused losses, however, tin can be carried forward and used in hereafter years (table two).

International issues

TCJA made sweeping changes to the handling of foreign source income and international financial flows. Nether prior law, the The states taxed the income of multinational firms on a worldwide ground, meaning that all income was taxed, regardless of where it was earned, less a credit for foreign taxes paid. Even so, the tax due on agile strange-source income of foreign subsidiaries of US multinationals was deferred until the income was made available to the US parent company.

The TCJA created a modified territorial revenue enhancement organisation. U.s. corporations continue to owe US taxes on the profits they earn in the United States. But TCJA exempted from taxation the dividends that domestic corporations receive from foreign corporations in which they own at to the lowest degree a 10 percent stake.

Under a pure territorial system, firms would accept a stiff incentive to shift real investment and reported income to low-tax jurisdictions overseas and to shift deductions into the Us. Several provisions were created as guardrails to reduce the extent to which companies take those deportment.

The minimum taxation on global intangible low-taxed income (GILTI) imposed a 10.v percent minimum taxation without deferral on profits earned abroad that exceed a business firm's "normal" return (divers in the law as 10 percent on the adjusted basis in tangible property held abroad). Companies tin can utilise 80 percent of their foreign tax credits, calculated on a worldwide ground, to offset this minimum revenue enhancement.

Whereas GILTI acts as a "stick" to preclude companies from making investments in intangible assets overseas, a deduction for strange-derived intangible income (FDII) acts as a "carrot" to provide an incentive for firms to hold intangible avails in their US affiliates. FDII is income received from exporting products whose intangible assets are held in the United States. For example, a pharmaceutical visitor will be able to deduct some income from overseas drug sales if the patent on the drug is held in its Usa parent company.

TCJA also created a new base erosion and antiabuse tax (BEAT), which—not surprisingly, given the acronym—is another "stick." BEAT imposes a minimum revenue enhancement on otherwise deductible payments betwixt a US corporation and a related foreign subsidiary.

To transition to the new organisation, TCJA created a new deemed repatriation tax for previously accumulated and untaxed earnings of strange subsidiaries of The states firms equal to 15.five percent for greenbacks and eight percent for illiquid assets. In 2015, it was estimated that US companies held more than $2.vi trillion in untaxed income in their foreign affiliates (Barthold 2016). Companies accept eight years to pay the tax, with a back-loaded minimum payment schedule specified in the law.

What Is 2018 Tax Law For Personal Service Corporationsc,

Source: https://www.taxpolicycenter.org/briefing-book/how-did-tax-cuts-and-jobs-act-change-business-taxes

Posted by: gardinanday1996.blogspot.com

0 Response to "What Is 2018 Tax Law For Personal Service Corporationsc"

Post a Comment